Structured Notes are a new investment option designed to offer potentially higher returns than traditional investments like deposits or regular bonds. They can also generate short-term cash flow regularly—even in a sideways market, when other investments may struggle to perform.

Investors don’t need to manage a stock portfolio or time the market themselves. Instead, they can invest in products linked to quality stocks in the SET50 index through contracts tailored to their investment goals and risk tolerance.

The expected return typically ranges from 5% to 30% per year, depending on the product terms, reference stocks, and market conditions. This makes Structured Notes suitable for those seeking short-term income and a more efficient, sustainable way to manage wealth.

Structured Notes (SN) are hybrid investment products that combine features of "bonds" and "derivatives." They offer returns that depend on the price movement of the underlying stock and are structured to match each investor’s needs and risk profile.

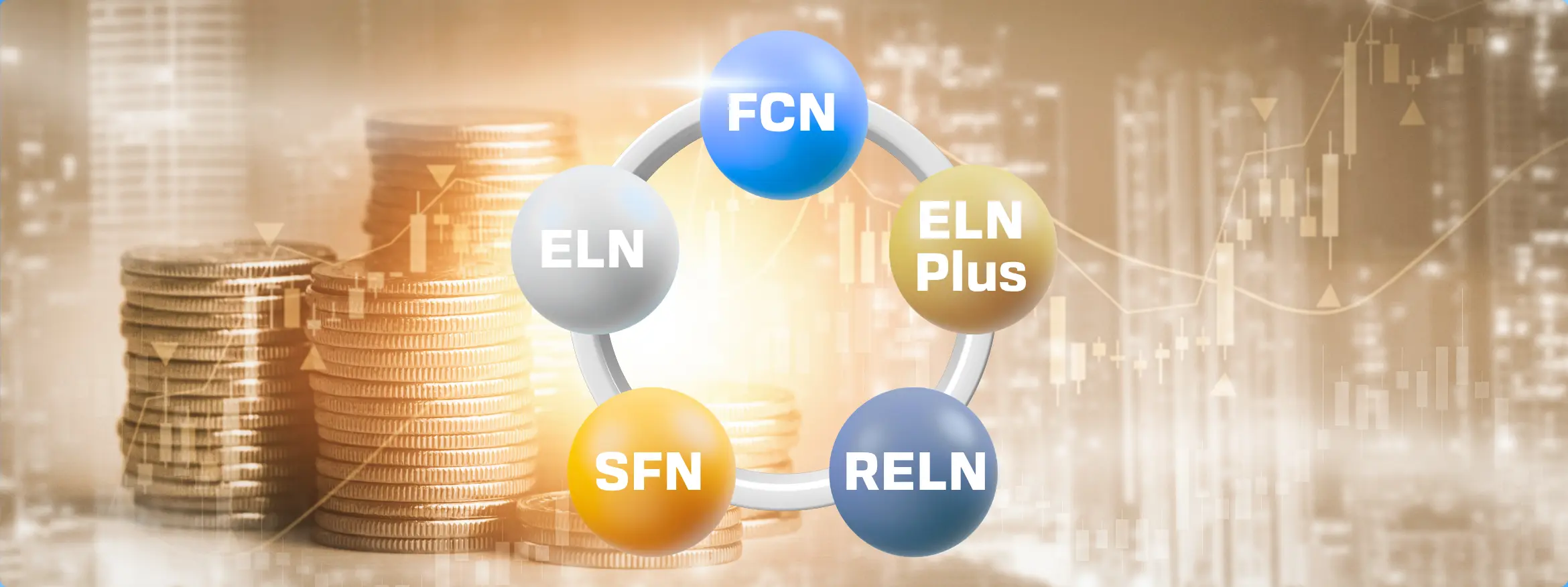

We offer a variety of products tailored to different investment objectives and risk levels, including:

Note: This product is available only to institutional and high-net-worth investors, as defined by the Securities and Exchange Commission (SEC) of Thailand.

Design your own contract—choose the underlying stock, set price levels, and duration.

Place orders based on live market prices to capture timely opportunities.

Monitor your structured note values with daily-updated Consolidated Portfolio reports.

Open securities account online with Bualuang Securities – quick and easy, no paperwork required! Just follow 3 simple steps and get approved in 15 minutes.