Investing globally opens the door to growth opportunities from various markets—not just Thailand. Especially in large markets like the U.S., where many world-class companies lead in innovation and have strong long-term growth potential.

With an automated portfolio, you don’t have to pick stocks or ETFs by yourself. The system automatically diversifies your investment and adjusts asset allocations based on your chosen strategy. This reduces the chance of making poor timing decisions, encourages consistent investing, and helps remove emotional or trend-based biases. You can build your global investment portfolio in a structured, convenient way—without constantly following the news—while still aiming for steady long-term returns.

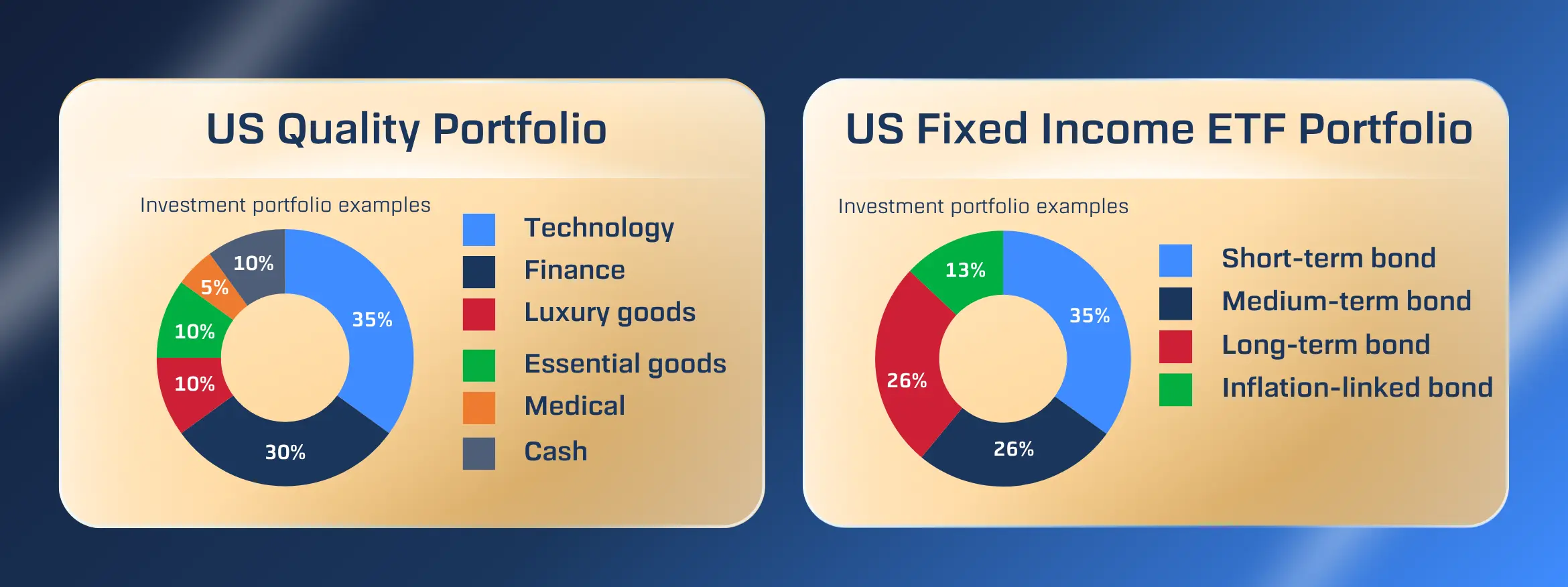

Auto Global Portfolio is an automated international investment service that diversifies your portfolio across global equities and ETFs. It uses a smart system to calculate asset allocation and automatically adjust your portfolio based on market conditions. Investors can choose between two strategies:

This service is ideal for investors with a lump sum—starting from just 1 million baht—who want to invest systematically, diversify into international markets, and enjoy convenience without having to monitor their portfolio themselves.

Carefully selected and diversified securities with strategically allocated weights.

Focus on high-potential international equities and ETFs with strong growth prospects.

Automatically rebalances asset allocation based on market conditions—convenient and hands-free.

Open securities account online with Bualuang Securities – quick and easy, no paperwork required! Just follow 3 simple steps and get approved in 15 minutes.

Auto Top Global Portfolio is a service that selects and allocates investments in global funds according to investor preferences. Investors do not need to select funds themselves, monitor the market, or manage rebalancing—everything is handled by professional investment managers.

There are two types of fees:

Note: Fees may vary depending on the fund’s policies.

No. Fund transactions in Auto Global Portfolio cannot be done through Global Trade Master. All orders are managed automatically through the Auto Investing system, and investors can monitor their portfolio via the or applications.

No. Once the portfolio is created, asset allocation cannot be adjusted manually. The system will automatically manage and rebalance the portfolio according to the set strategy.

Yes, there may be. For U.S. funds, for example, a withholding tax of approximately on dividends may apply, depending on the fund’s structure and the U.S. IRS regulations.