Investing in fixed income is a good option for those looking for regular income and stable long-term returns. Bonds are considered low-risk because investors hold the status of a “creditor,” meaning they have a higher priority to receive repayment than common shareholders. This helps reduce risk and lower the overall volatility of an investment portfolio.

In addition, bonds can be traded on the secondary market, allowing investors to potentially earn extra profit from price changes. There is also a wide variety of choices, including both government and corporate bonds, across different risk levels to suit each investor’s preference.

Fixed Income is a financial tool issued by an entity — such as a government or a private company — to raise funds from investors. Investors receive interest as a return over a specified period, and the full principal is repaid when the instrument reaches maturity. In this case, the investor is the creditor, and the issuer is the borrower.

There are two main types of fixed income:

These instruments can be bought and sold in both the primary market and secondary market, helping improve liquidity and providing more chances to profit from price changes.

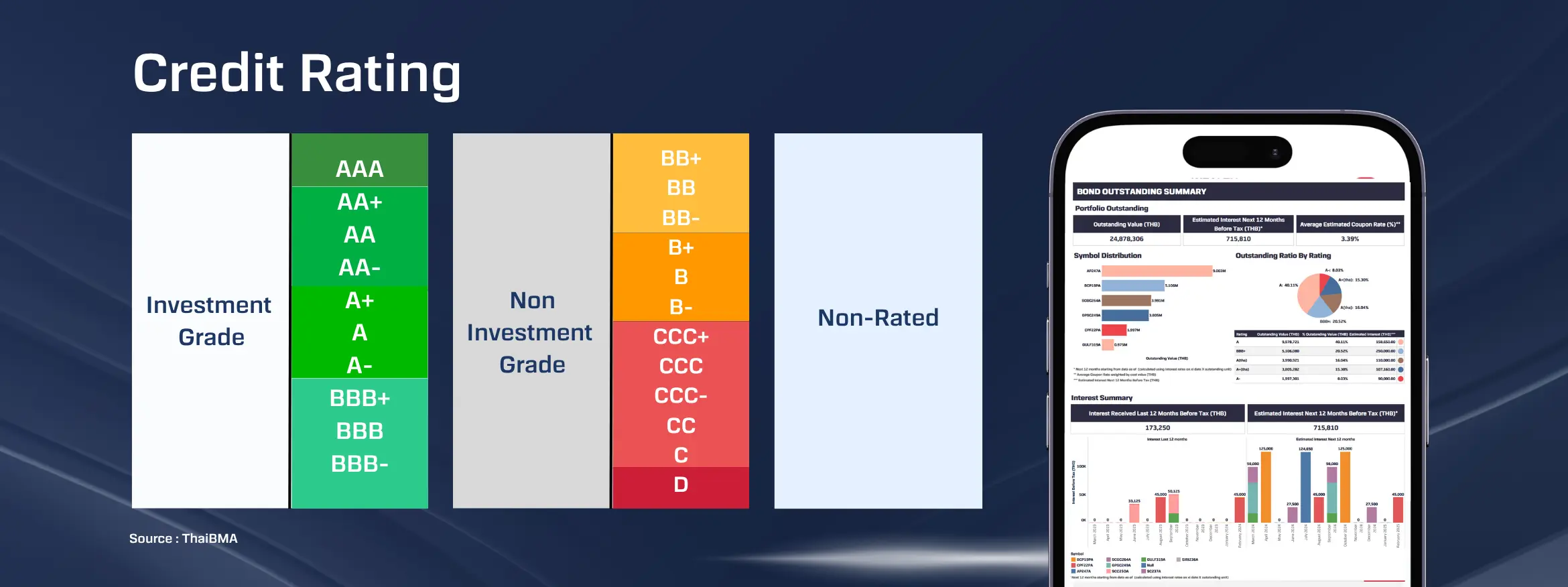

Risks to be aware of when investing in fixed income:

Investing through Bualuang Securities gives you access to a full range of debt investment services, including both primary and secondary markets. You’ll be supported by a team of experts who carefully select quality instruments and offer professional advice. All investments are managed securely through a scripless system, so there’s no risk of losing physical certificates — and you can start investing right away with a standard securities trading account.

In addition, investors can track the prices of fixed income investments held in their portfolio with the company through the BLS Consolidated Portfolio report, along with alerts such as notifications when the investment reaches its interest entitlement date (XI Date).

Focused on selecting high-quality fixed income instruments with a diverse range across categories.

Easily transfer your existing scripless bonds into your portfolio with BLS.

Get interest payment notifications and regular forecasts of upcoming interest income.

Open securities account online with Bualuang Securities – quick and easy, no paperwork required! Just follow 3 simple steps and get approved in 15 minutes.