How to use an SBL Service ?

If a BLS customer wants to use Securities Borrowing and Lending Service: SBL, you will have to request to register before using as the steps follow.

How to check an SBL Service status, ready to use or not ?

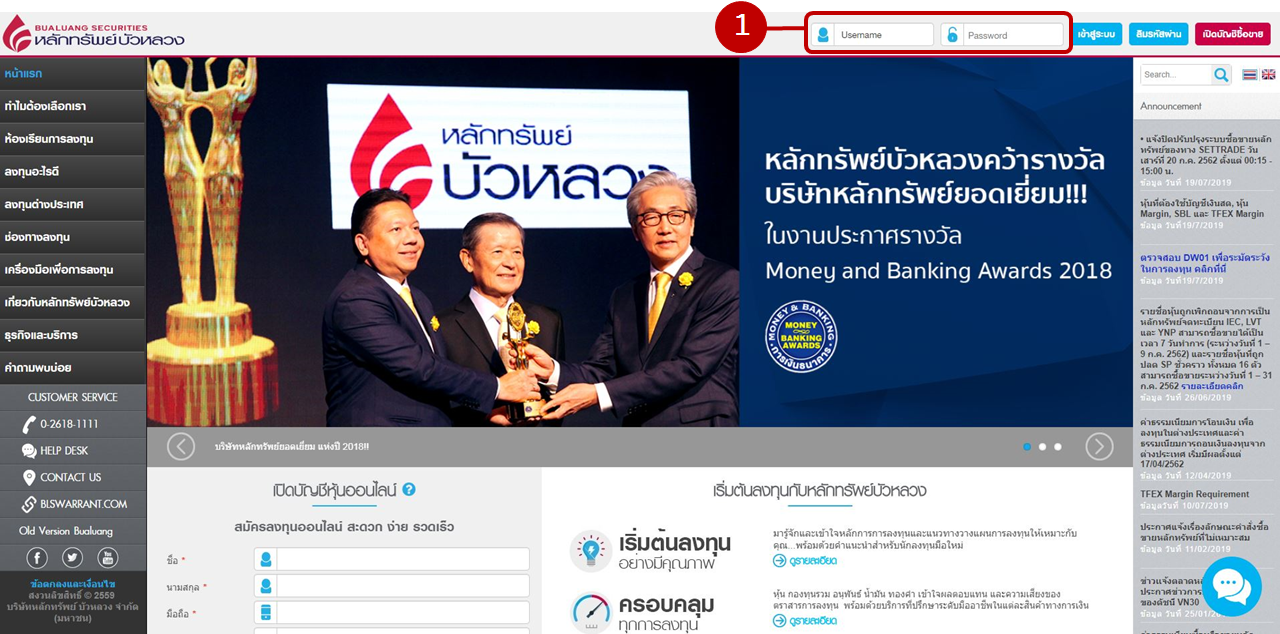

For a BLS customer who already registered SBL service and need to know the status ready to use or not? You can check it on www.bualuang.co.th as follows :

1. Log in via www.bualuang.co.th fill your Username and Password, and then log in.

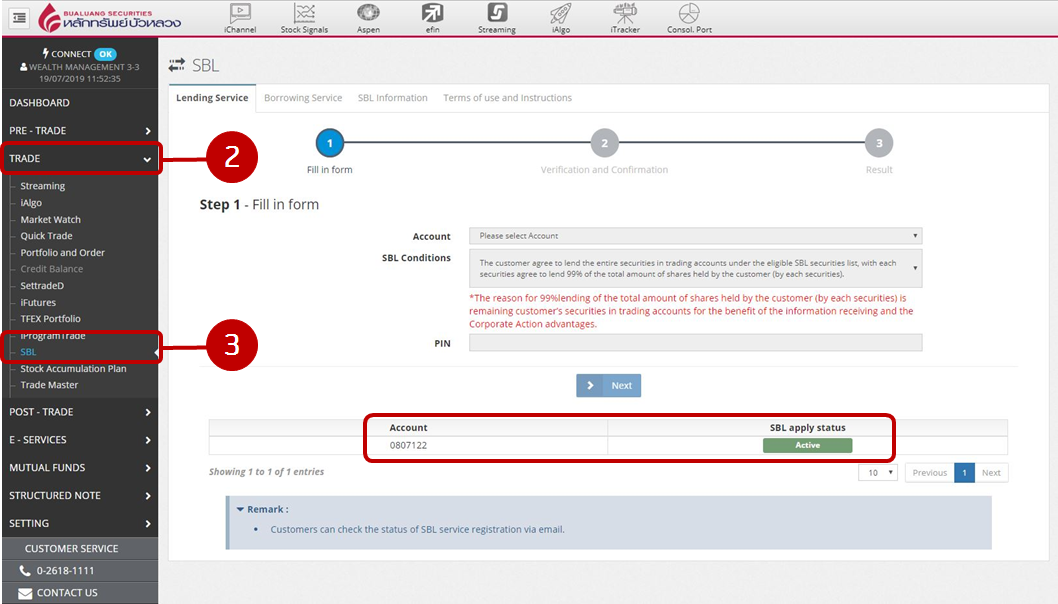

2. Choose the main menu “TRADE”, after that choose the sub menu “SBL”.

When applying for the SBL service and ready to use it, the page will display Active status as shown.

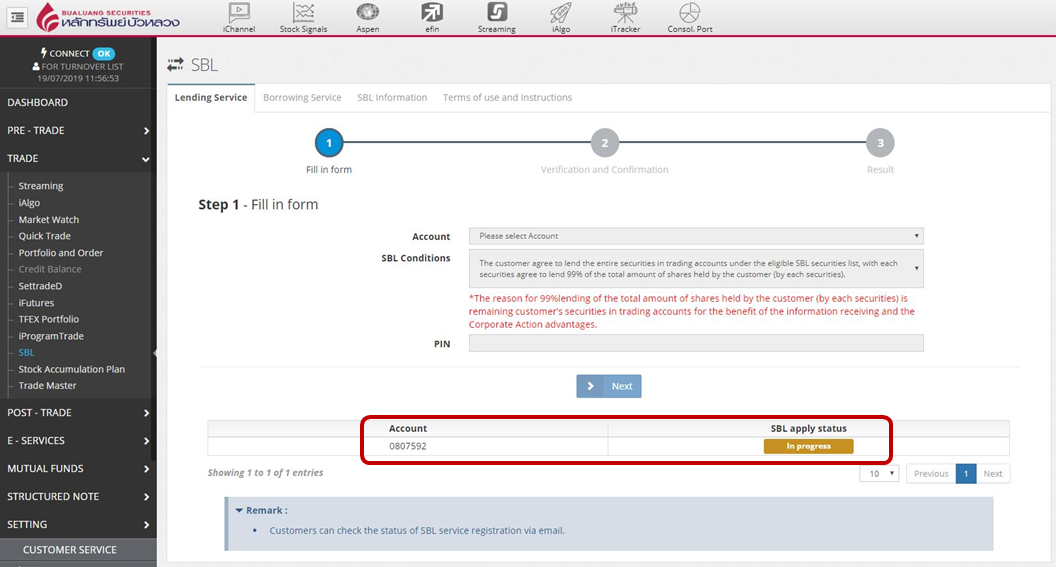

If you are in the process of applying for the SBL service, the screen will display the status In progress as shown.

Frequently asked Questions for Lender.

1. What is the allowable securities list to lend ?

Securities that can lend must be the securities are in the SBL Securities List, announced by Bualuang Securities for every half year according to SET50/SET100 announcement by SET. BLS customers can check the list of SBL securities that the company allows to lend as attached Click

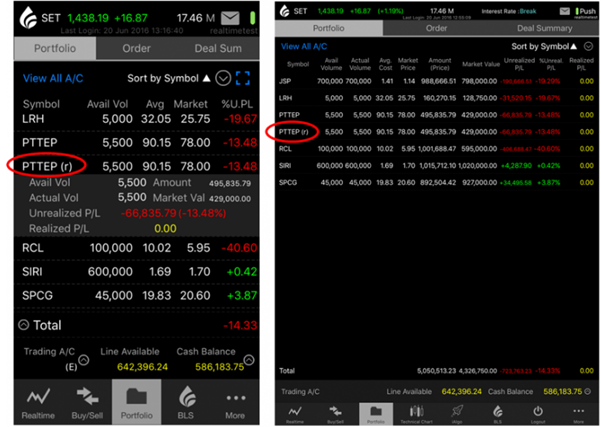

2. How to know that the securities belong to customers have been lent already ?

Securities that have been lent already will be shown as “appear (r) at the end of the securities name” and split to another line

3. While the securities were lent. If there are corporate actions of any benefits, will the lender (owner of the lending securities) still receive those rights ?

The SBL system will cancel the securities lending order and return the securities back to the trading account of the lender, before the securities corporate actions occur XD, XA, XR, XW, XB (except XM, where if the owner of the securities wants to attend the meeting, the lender must request at least 2 days before the XM occur, any the current lending option mostly recommend customers to allow lending for 99% of each securities for always attending meeting without request securities back.)

4. How to sell the lending securities while they have been lent ?

The securities owner (lender) can send selling orders as usual. For the SBL current system, there is no different process to normal operation.

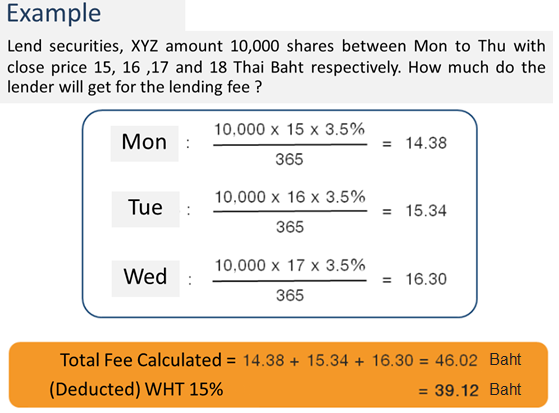

5. How to calculate the lending fee? And when the lender will get it ?

The lending fee is 3.5% p.a. (before deducted withholding tax by 15%), which is calculated on a daily basis with daily close price. Pay into the trading accounts every the first business day of each month or T+2 after the ending transaction date, whatever any event occur first.

Frequently asked Questions for Borrower.

1. What is the allowable securities list to borrow ?

Securities that can borrow must be the securities are in the SBL Securities List (same as the lending securities list), announced by Bualuang Securities for every half year according to SET50/SET100 announcement by SET. BLS customers can check the list of SBL securities that the company allows to borrow as attached Click

2. How to request to borrow securities ?

Firstly, if the BLS customer wants to borrow securities, the customer must be deposited the collateral, only cash for the current system, in the SBL trading account before borrow. Then, how much the collateral has been deposited, it can borrow twice (for the exact policy it called must deposit for half of borrowing securities value).

For example : the customer wants to borrow BBL for short selling by 1,000 shares, which its previous day close price is 181 THB/share. So, the customer must be deposited at least 90,500 THB before request to borrow.

After process to deposit collateral already, the customer can contact to his/her Investment Consultant (IC) for borrowing securities. Which securities? How many shares?

For the customer who succeeds to borrow securities, we recommend you to order to short selling immediately. Otherwise before 3 p.m., the borrower must be deposited more collateral (roughly additional collateral equal to the borrowing securities value) or before the market close, the borrower must return the securities but have to pay borrowing fee for 1 day even the borrower does not succeed to short sell.

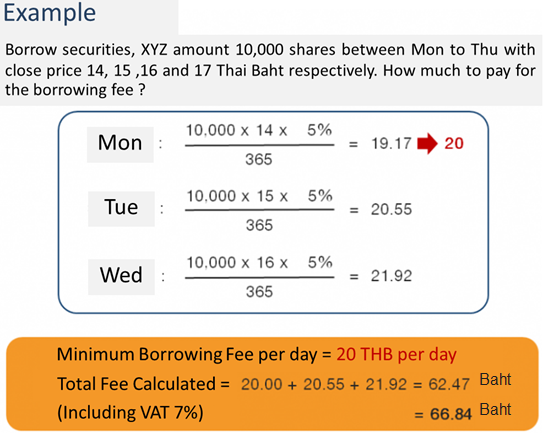

3. How to calculate the borrowing fee ?

The borrowing fee is 5.0% p.a. (before including VAT 7%), calculated on daily basis same as lending fee methodology. Determined minimum borrowing fee for 20 THB per day.