Tender Offer is a benefit for shareholders of a listed company. It is an agreement to buy securities from general shareholders outside the stock exchange. The buyer will specify the price, number of shares to be purchased, and the period of time for buying securities.

Currently, there are three types of Tender Offer:

1. Mandatory Tender Offer: This is when a shareholder acquires shares up to the level specified by law, which triggers a legal obligation, or Trigger Point, such as 25%, 50%, or 75% of the total voting rights of the company.

2. Voluntary Tender Offer: This is when a shareholder makes a tender offer for shares on a voluntary basis. They have not acquired shares up to the Trigger Point, so they do not have a legal obligation, but they want to have control over the company.

3. Delisting tender offer: This is when a company makes a tender offer to buy back shares from general investors. The company plans to delist its shares from the market, which will affect the liquidity of the shares. This is because individual investors will not be able to sell their shares on the stock exchange.

Currently, there are two ways to exercise Tender Offer rights:

1. Contact your marketing officer to confirm your rights.

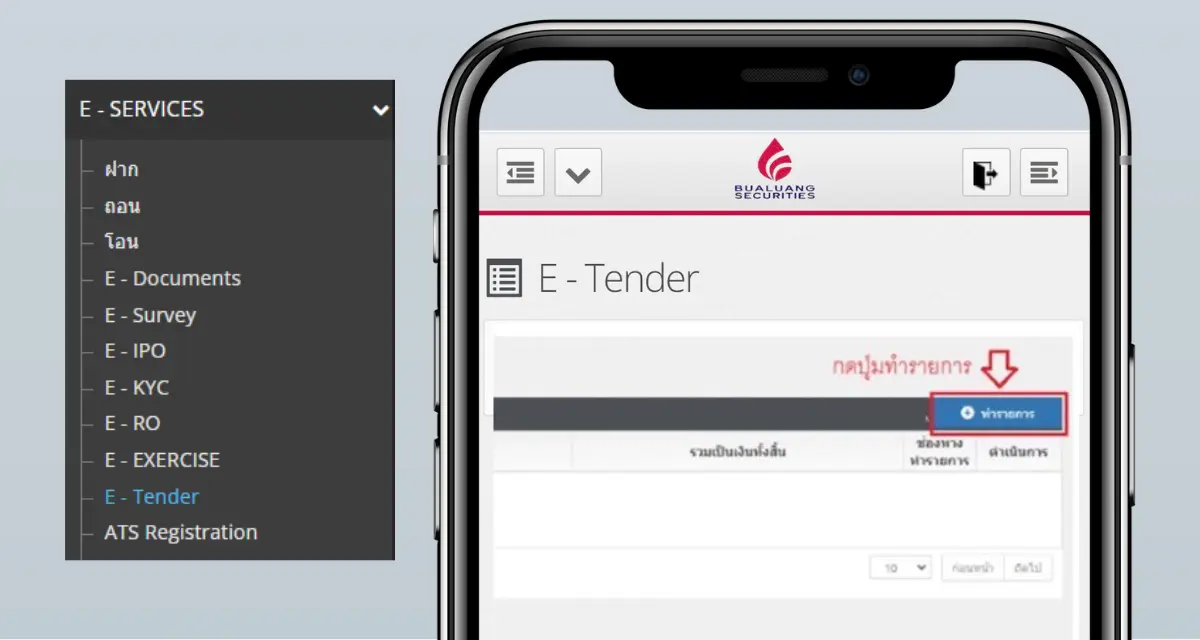

2. Submit an order through the online E-Tender system.

Special Privileges for Bualuang Securities Customers can use E-Tender conveniently and add a payment method by cutting collateral in the securities account when Bualuang Securities Public Company Limited is appointed as the representative to purchase securities.

Get started in just 3 simple steps with no document submission required. Your account will be approved within 15 minutes. Then, simply download and log in to the app.