Right Offering (RO) is a process where a company raises capital by issuing new shares and selling them to existing shareholders. The proceeds from the offering are used for the purposes announced by the company,

such as business expansion, debt repayment, or to offset accumulated losses. Each increase in capital can have both positive and negative effects on existing shareholders, depending on how the company uses the proceeds from the increase in capital.

To receive the right to participate in a RO, investors must purchase the stock before the XR date and hold the stock until the XR date (Excluding Rights).

Currently, there are two channels to exercise RO rights:

1. Submit a rights exercise form through your investment advisor.

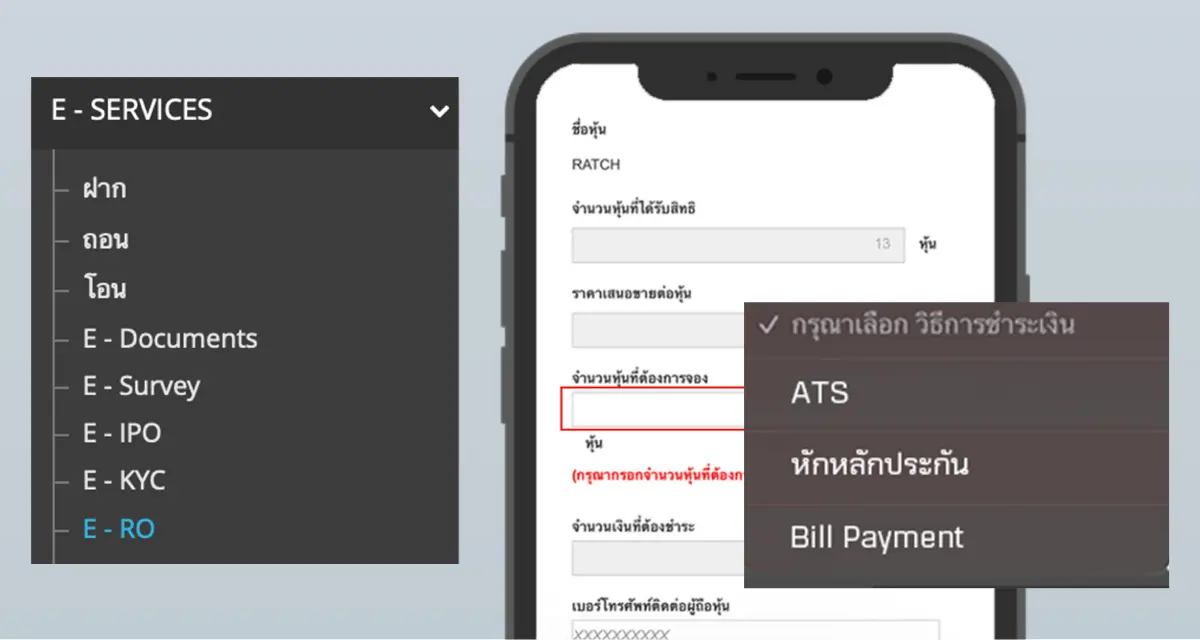

2. Use the online system of the representative or broker that is accepting the offering.

Convenient E-RO service with the addition of a payment method that allows for deductions from the securities account margin.

Get started in just 3 simple steps with no document submission required. Your account will be approved within 15 minutes. Then, simply download and log in to the app.