To conduct Know Your Customer (KYC) through electronic systems, which is a required step to start financial transactions according to the Securities and Exchange Commission (SEC) regulations. This ensures that customers are the actual people making transactions, have a source of funds, and know the real beneficiaries under the anti-money laundering law.

E-KYC uses electronic systems to identify (Identification) and verify (Verification) identities instead of the old system that requires customers to visit branches to verify their identities.

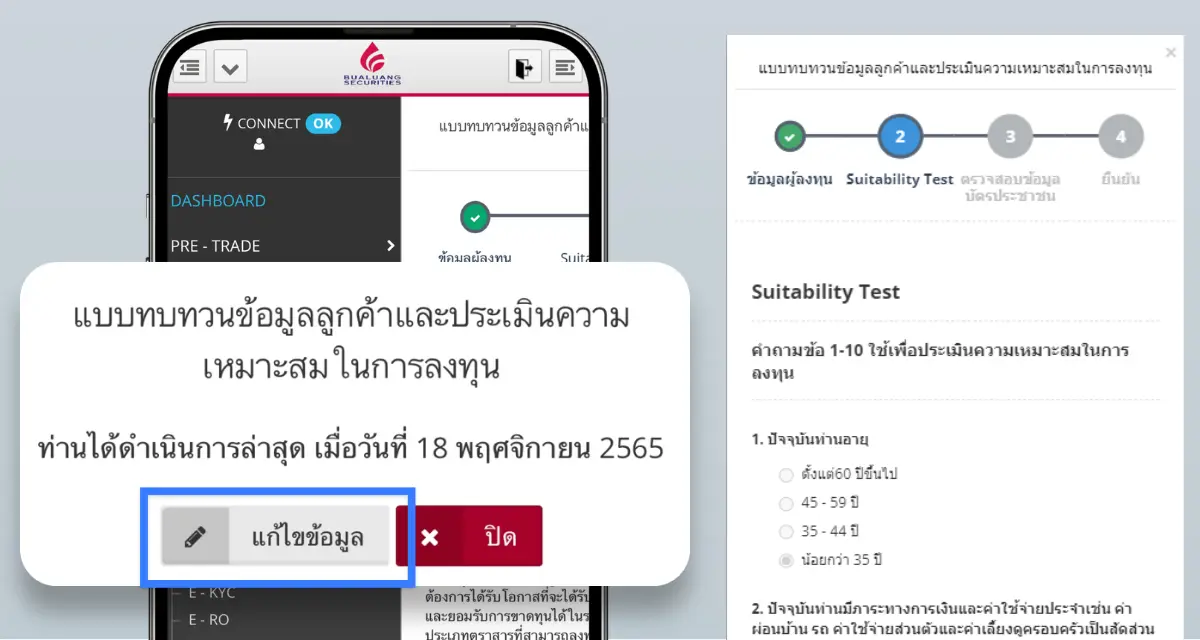

E-KYC is a convenient tool that eliminates the need for documents or branch visits. Customers can update their personal information through online channels in one go, including:

However, KYC data reviews must be updated regularly every 2 years.

Get started in just 3 simple steps with no document submission required. Your account will be approved within 15 minutes. Then, simply download and log in to the app.