Initial Public Offerings (IPOs) are a great opportunity for investors to own shares in growing companies with a bright future.

Currently, there are two common allocation methods:

1 Allocation based on criteria set by the distributing brokerage firm: The brokerage firm will set criteria for selecting investors who are eligible to subscribe for IPO shares. These criteria may consider factors such as average trading value, account balance, and number of shares subscribed.

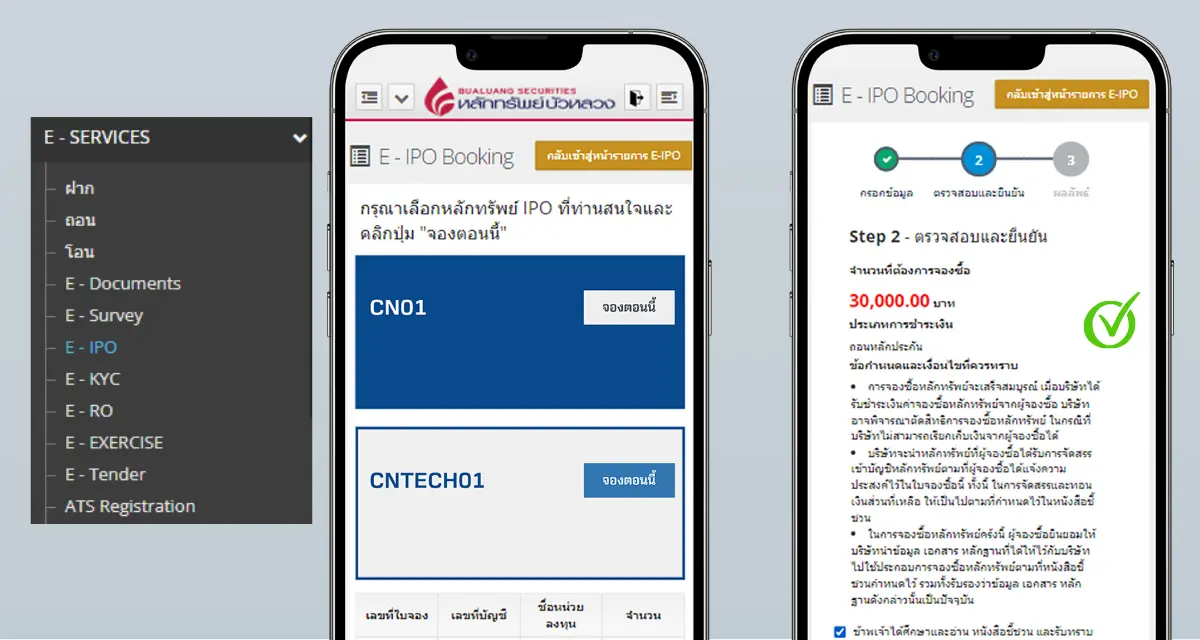

2 Special privilege for Bualuang Securities customers: Bualuang Securities offers a special privilege to allow the public to subscribe for IPO shares on a random basis. This method was first introduced with the IPO of OR and is unique in that it allows the general public to subscribe for shares without any eligibility criteria. However, full payment must be made before the system will randomly allocate the number of shares to each investor.

IPOs are another source of capital for entrepreneurs or business owners who want to expand their businesses. In addition to borrowing money from banks, companies can list their shares on the stock exchange and offer them for sale to the public. This is known as an IPO.

Securities that can be IPOed

1 SET or mai shares

2 REITs (Real Estate Investment Trusts)

3 Infrastructure funds

4 DR units

Get started in just 3 simple steps with no document submission required. Your account will be approved within 15 minutes. Then, simply download and log in to the app.