Futures

SET50 Index Futures

is the first product to be traded on TFEX. SET50 Index was launched in 1995 and it is the first large-cap index of Thailand to provide a benchmark of investment in The Stock Exchange of Thailand. It is calculated from the stock prices of the top 50 listed companies on SET in terms of large market capitalization, high liquidity.

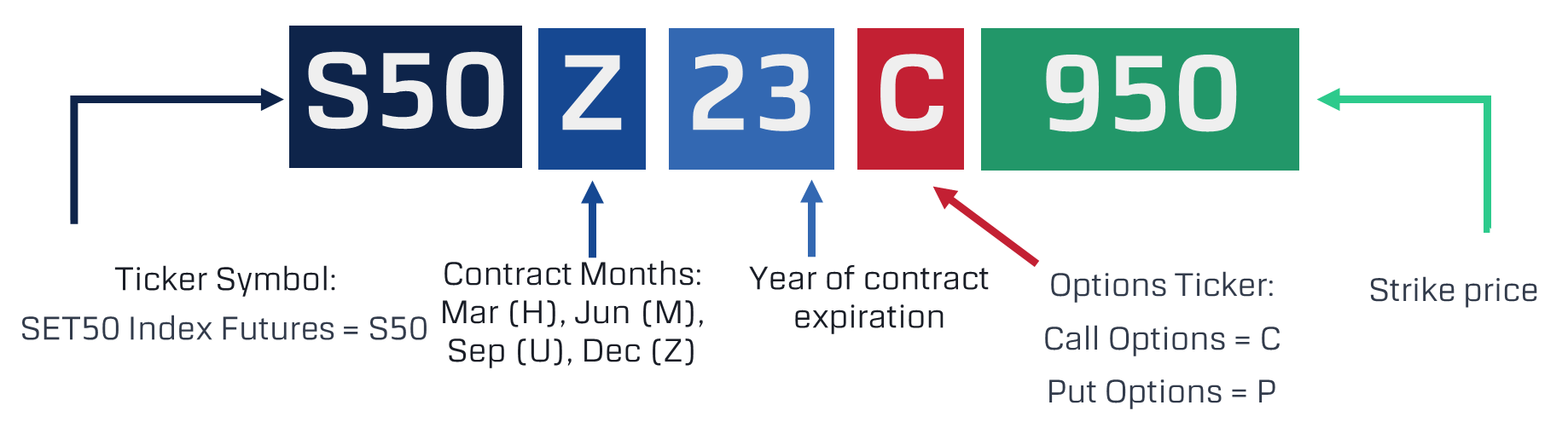

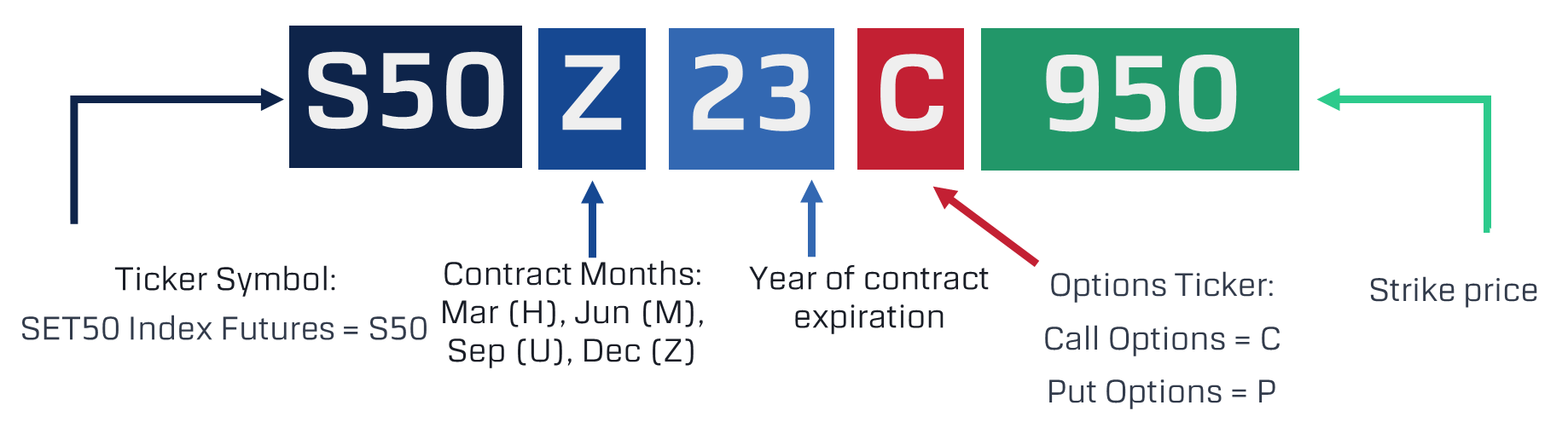

Contract symbol:

Characteristics of a Contract:

SET50 Index Options

is a contract that gives the buyer the right, but not the obligation, to buy or sell SET50 Index at a specific price on or before a certain date. An option, just like a stock or bond, is a security. It is also a binding contract with strictly defined terms and properties. The advantage of options is that you aren't limited to making a profit only when the market goes up. Because of the versatility of options, Investors can also make money when the market goes down or even sideways. SET50 Index Options is the second product on TFEX and was launched on October 29th, 2007. SET50 Index Options is currently using European options.

Contract symbol:

Characteristics of a Contract:

📌 Register TFEX/Block Trade account online via Wealth Connex Click here

☎ Contact for more information with BLS Customer Service Tel. 0-2618-1111

is the first product to be traded on TFEX. SET50 Index was launched in 1995 and it is the first large-cap index of Thailand to provide a benchmark of investment in The Stock Exchange of Thailand. It is calculated from the stock prices of the top 50 listed companies on SET in terms of large market capitalization, high liquidity.

Contract symbol:

Characteristics of a Contract:

| Topic | SET50 Index Futures |

| Underlying Asset | SET50 Index which is compiled, computed and disseminated by the Stock Exchange of Thailand |

| Contract Size | THB 200 per index point |

| Tick size | 0.1 index point (or THB 20 per contract) |

| Contract Months | 3 nearest consecutive months plus the next 3 quarterly months (Mar, Jun, Sep, or Dec) |

| Trading hours | Morning Session: 09:45 A.M. - 12:30 P.M. Afternoon Session: 14:15 P.M. - 16:55 P.M. |

SET50 Index Options

is a contract that gives the buyer the right, but not the obligation, to buy or sell SET50 Index at a specific price on or before a certain date. An option, just like a stock or bond, is a security. It is also a binding contract with strictly defined terms and properties. The advantage of options is that you aren't limited to making a profit only when the market goes up. Because of the versatility of options, Investors can also make money when the market goes down or even sideways. SET50 Index Options is the second product on TFEX and was launched on October 29th, 2007. SET50 Index Options is currently using European options.

Contract symbol:

Characteristics of a Contract:

| Topic | SET50 Index Options |

| Underlying Asset | SET50 Index which is compiled, computed and disseminated by the Stock Exchange of Thailand |

| Ticker Symbol | S50C: Call Options S50P: Put Options |

| Contract Size | THB 200 per index point |

| Tick size | 0.1 index point (or THB 20 per contract) |

| Initial Margin | Long Position: Pay only Premium Short Position: Collect margin according to TCH |

| Contract Months | 3 nearest consecutive months plus 1 quarterly months (Mar, Jun, Sep, or Dec) |

| Trading hours | Morning Session: 09:45 A.M. - 12:30 P.M. Afternoon Session: 14:15 P.M. - 16:55 P.M. |

📌 Register TFEX/Block Trade account online via Wealth Connex Click here

☎ Contact for more information with BLS Customer Service Tel. 0-2618-1111